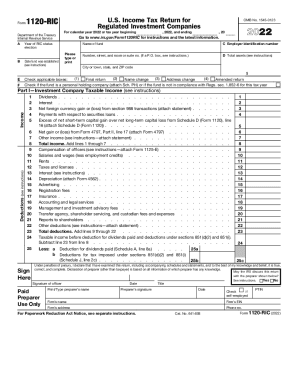

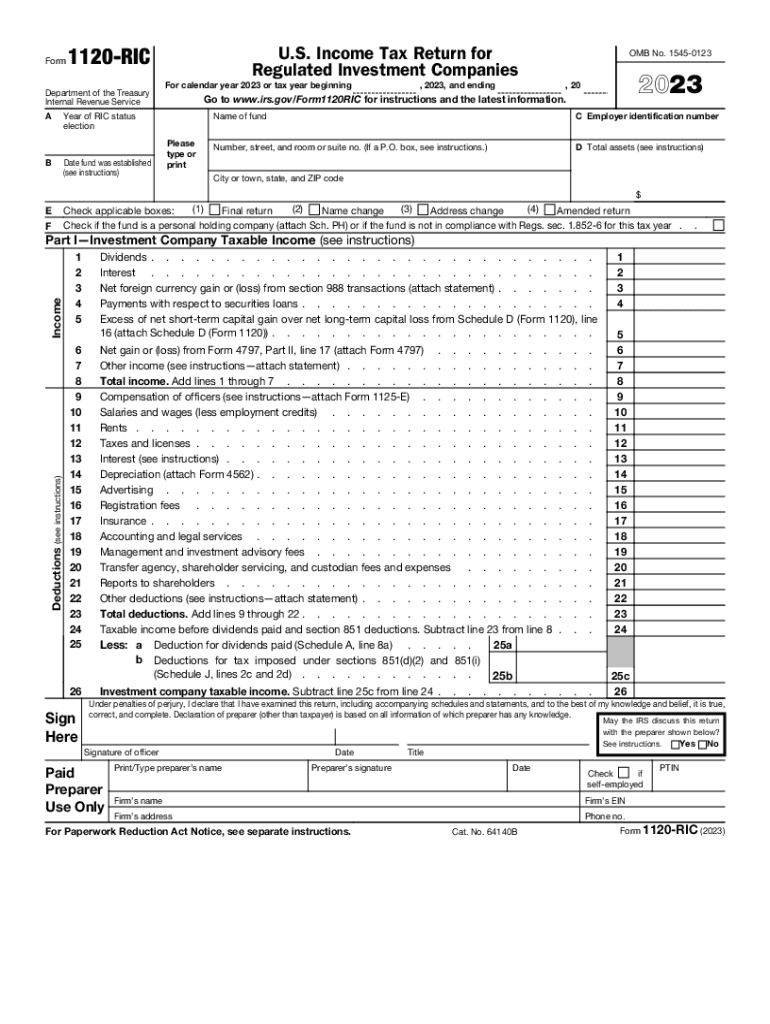

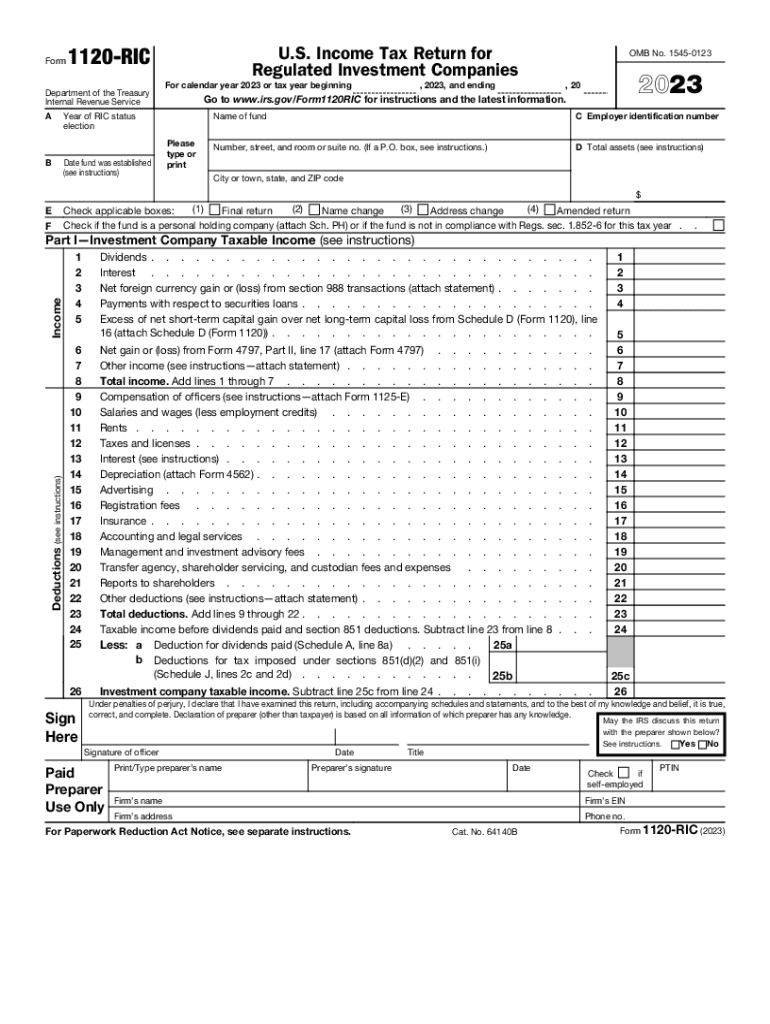

IRS 1120-RIC 2023-2024 free printable template

Get, Create, Make and Sign

How to edit 1120 tax form online

IRS 1120-RIC Form Versions

About 1120 tax form

How to fill out 1120 tax form 2023-2024

How to fill out 1120 tax form

Who needs 1120 tax form?

Video instructions and help with filling out and completing 1120 tax form

Instructions and Help about form 1120 ric instructions

Okay for this video I wanted to cover a simple tutorial on how to complete a form 1120 corporate tax return uh for the 2021 tax year for a newly formed corporate entity, so it's going to be a very simple example nothing too complex but what we're going to do is I've got a sample form 1120 in front of us that I've that I've completed, and I've got the supporting documents, and so we'll look at those and the fact pattern it will go back and forth between the supporting docs and this return to show you how the fields are completed what additional forms or schedules you might need so what do we have in front of us I've got the sample form 1120 like I said, and then I've got a slide here which covers the fact pattern that we're going to be working with at some details on the company and some additional elements that we're going to need to factor in when we complete the return, and then I've got an Excel file here which has the sample financial statements for our fake corporations, so we've got a p l a profit and...

Fill irs ric : Try Risk Free

People Also Ask about 1120 tax form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 1120 tax form 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1120 Tax Forms is not the form you're looking for?Search for another form here.

Quick facts to know before filling out the form