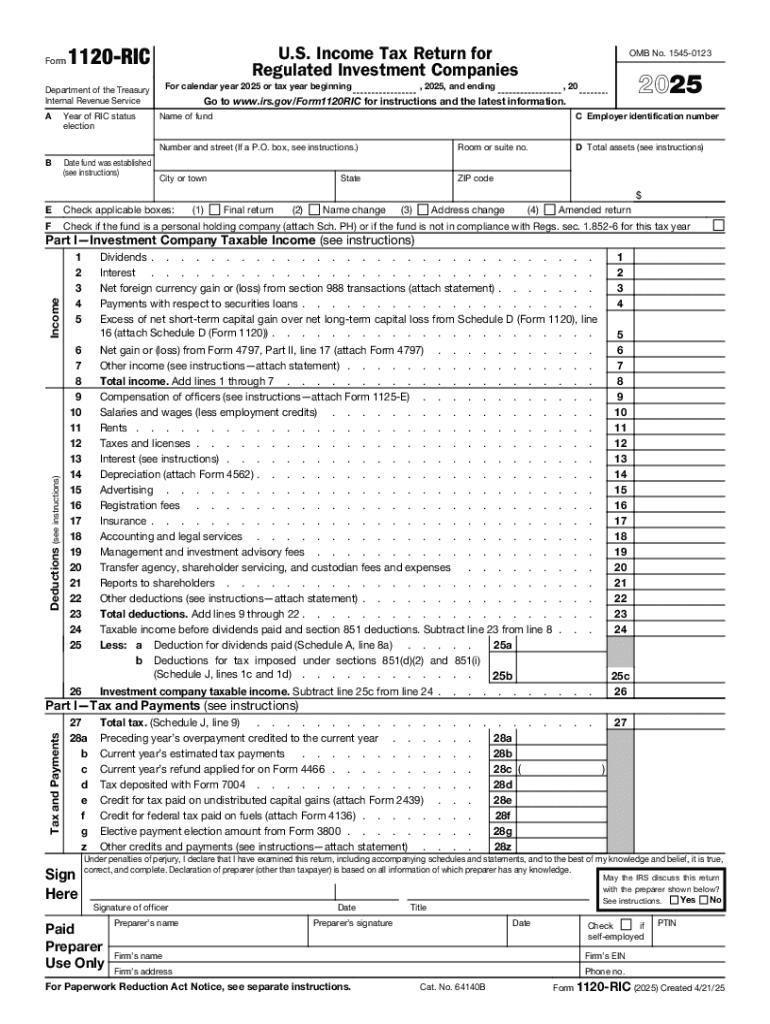

IRS 1120-RIC 2025-2026 free printable template

Instructions and Help about IRS 1120-RIC

How to edit IRS 1120-RIC

How to fill out IRS 1120-RIC

Latest updates to IRS 1120-RIC

All You Need to Know About IRS 1120-RIC

What is IRS 1120-RIC?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-RIC

What should I do if I need to correct an error after filing IRS 1120-RIC?

If you find an error after submitting your IRS 1120-RIC, it's essential to file an amended return. Use Form 1120-RIC to report the corrections, and ensure it is marked as 'amended' for clarity. Keep a copy of the original and amended forms for your records to maintain clarity on your filings.

How can I track the status of my IRS 1120-RIC after submission?

To verify the receipt and processing status of your IRS 1120-RIC, you can use the IRS online tools or call their support line. It's important to have your submission details ready for reference, as common e-file rejection codes may provide further insight into processing issues, if any.

What legal considerations should I keep in mind while filing IRS 1120-RIC?

When filing the IRS 1120-RIC, consider the privacy and data security aspects of your submission. Ensure you are aware of the acceptable e-signature guidelines, especially if you are filing on behalf of another party or using an authorized representative. It's also crucial to retain copies of your filed forms for the required duration as per IRS guidelines.

What pitfalls should I avoid while filing the IRS 1120-RIC to ensure acceptance?

Common errors in filing the IRS 1120-RIC include incorrect calculations and missing information. Double-check your entries against the IRS requirements, and consider using software tools designed for tax filings that flag potential issues. Ensuring all details are accurate will help avoid rejections and delays in processing.

What should I do if I receive a notice related to my IRS 1120-RIC submission?

If you receive a notice or letter from the IRS regarding your IRS 1120-RIC, carefully read the documentation to understand the issue. Prepare any necessary documentation to respond, and follow the instructions provided in the notice. Timely responses can help prevent further complications or penalties.