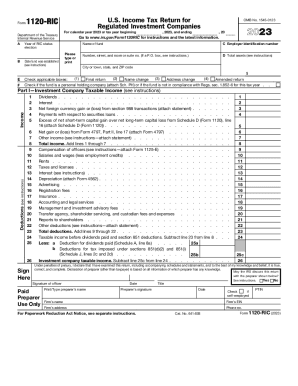

IRS 1120-RIC 2024-2025 free printable template

Show details

Form U.S. Income Tax Return for Regulated Investment Companies 1120-RIC Department of the Treasury Internal Revenue Service A Year of RIC status election B Date fund was established see instructions For calendar year 2024 or tax year beginning OMB No. 1545-0123 2024 and ending Go to www.irs.gov/Form1120RIC for instructions and the latest information. Please type or print Name of fund C Employer identification number Number street and room or suite no. If a P. O. box see instructions. D Total...

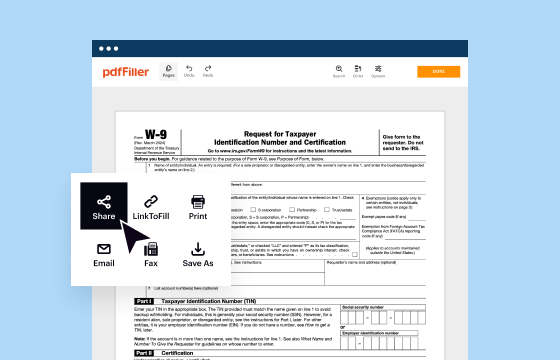

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 1120-RIC

A Guide to Completing IRS Form 1120-RIC

How to Accurately Fill Out the Form

Understanding and Utilizing IRS Form 1120-RIC

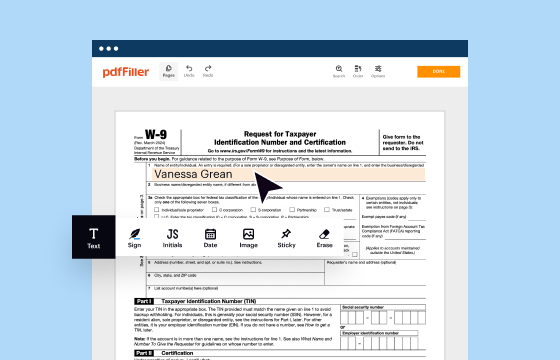

The IRS Form 1120-RIC serves as an essential tax document specifically designed for regulated investment companies (RICs). This guide aims to demystify the intricacies of this form, offering detailed insights into its purpose, required information, and filing procedures. Understanding the nuances of Form 1120-RIC not only ensures compliance but also enhances effective tax planning within the RIC framework.

A Guide to Completing IRS Form 1120-RIC

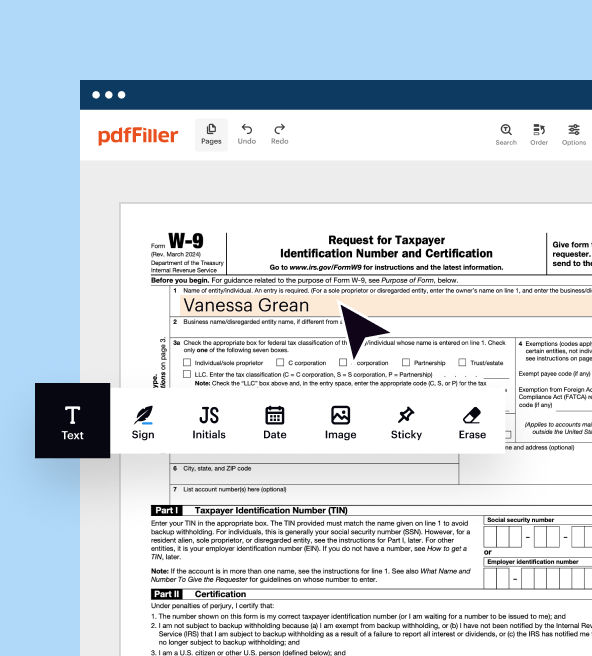

Filling out IRS Form 1120-RIC can seem daunting, but following these structured steps can pave the way for accuracy and efficiency:

01

Gather all necessary documentation, including financial statements and shareholder records.

02

Begin by filling in your company’s identifying information, such as name, Employer Identification Number (EIN), and address.

03

Report the company's income by entering amounts from the financial statements, including dividends and interest received.

04

Detail your deductions and special tax-related items, such as expenses attributable to the RIC structure.

05

Calculate the tax due based on the reported income and applicable tax rates.

06

Review all fields for accuracy and ensure all calculations align before submission.

07

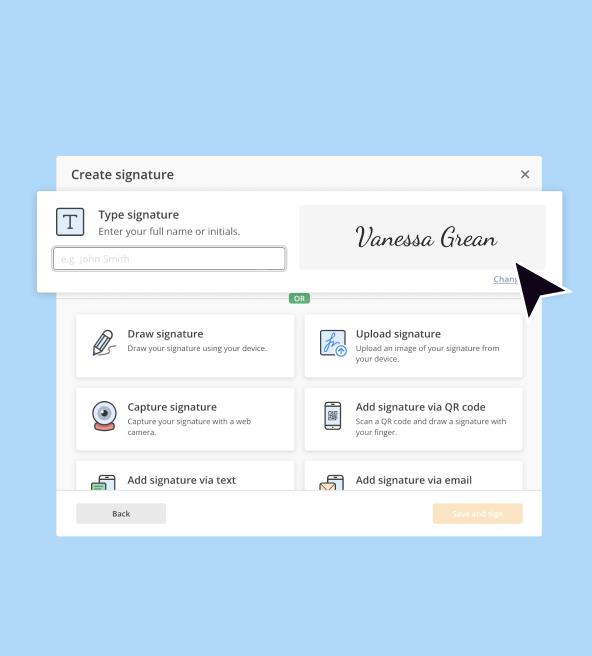

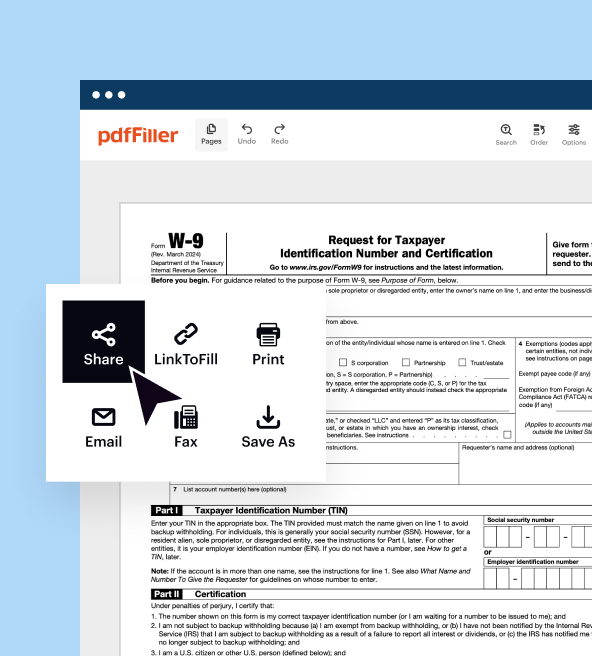

Sign and date the form before sending it to the appropriate IRS address based on the filing requirements.

How to Accurately Fill Out the Form

Completing IRS Form 1120-RIC involves several critical components that must be meticulously reported. Here are key areas to focus on:

01

Part I requires information about the corporation’s income and deductions, including details on investment dividends, interest income, and any related expenses.

02

Part II outlines the special deductions available to RICs, which often include expenses incurred directly in the management of investments.

03

Part III is dedicated to the calculation of the required distribution, illustrating how much of the income must be distributed to shareholders to maintain RIC status.

04

Ensure to include schedules that support deductions and distributions, providing a comprehensive overview to the IRS.

Show more

Show less

Recent Modifications to IRS Form 1120-RIC

Recent Modifications to IRS Form 1120-RIC

Recent updates to IRS Form 1120-RIC are crucial for RICs to adhere to evolving regulatory requirements. Changes can include:

01

Adjustment of thresholds for certain income classifications per recent tax legislation.

02

Altered reporting requirements which enhance clarity in financial disclosures.

03

New lines added for reporting specific types of investment income and expenses relevant to current market conditions.

Essential Insights on IRS Form 1120-RIC

Defining IRS Form 1120-RIC

Purpose of IRS Form 1120-RIC

Who Needs to File Form 1120-RIC?

Understanding Exemptions from Filing

When Is the Filing Deadline for IRS Form 1120-RIC?

Comparing IRS Form 1120-RIC with Similar Tax Forms

Transactions Covered under Form 1120-RIC

Submission Address for IRS Form 1120-RIC

Potential Penalties for Non-Compliance

Information Required for Filing IRS Form 1120-RIC

Additional Forms Accompanying IRS Form 1120-RIC

Essential Insights on IRS Form 1120-RIC

Defining IRS Form 1120-RIC

IRS Form 1120-RIC is specifically tailored for regulated investment companies, which are mutual funds or similar investment pools that pass through income to shareholders. This form facilitates the appropriate reporting of earnings, deductions, and tax liabilities that RICs face under the tax code.

Purpose of IRS Form 1120-RIC

The primary purpose of Form 1120-RIC is to ensure that RICs accurately report their income and adhere to distribution requirements mandated by the IRS. Proper completion of this form enables RICs to qualify for favorable tax treatment while complying with federal regulations.

Who Needs to File Form 1120-RIC?

Any corporation that qualifies as a regulated investment company and wishes to retain this classification is required to file Form 1120-RIC. This generally includes entities that have significantly invested in securities and distributed a majority of their income to shareholders during the tax year.

Understanding Exemptions from Filing

Certain circumstances may exempt a corporation from filing Form 1120-RIC. These exemptions may include:

01

If the RIC has a total gross income below a specified threshold, often established legislatively.

02

Entities transitioning to a non-RIC status, pending IRS approval.

03

Special cases involving short tax years or changes in ownership structure.

When Is the Filing Deadline for IRS Form 1120-RIC?

The standard deadline for filing IRS Form 1120-RIC is March 15. If your corporation operates on a fiscal year, this date corresponds with the third month following the fiscal year-end. Additionally, filing extensions may be available under certain conditions.

Comparing IRS Form 1120-RIC with Similar Tax Forms

Unlike IRS Form 1120, which is for standard corporations, IRS Form 1120-RIC encompasses specific regulations governing investment companies. It also has a distinct focus on income distribution requirements, which differ significantly from other corporate forms.

Transactions Covered under Form 1120-RIC

Transactions typically reported include earnings acquired from investments, expenses incurred in the management of the portfolio, and compliance with distribution requirements. Additionally, transactions involving derivatives or other complex financial instruments may also be relevant depending on the RIC’s investment strategy.

Submission Address for IRS Form 1120-RIC

When submitting your completed IRS Form 1120-RIC, ensure it is mailed to the designated IRS address indicated in the form instructions. The address often varies based on the principal location of the RIC and the method of submission (standard mail, expedited services, etc.).

Potential Penalties for Non-Compliance

Failing to submit IRS Form 1120-RIC can result in multiple penalties, reflecting the severity of non-compliance:

01

Financial penalties can range from $200 per day for each day the return is late.

02

Legal consequences can emerge from failure to comply with distribution requirements, potentially risking the RIC’s tax status.

03

Additional fines may be imposed if inaccurate information is reported, underscoring the importance of thoroughness in preparation.

Information Required for Filing IRS Form 1120-RIC

To ensure a complete filing, the following information should be collated:

01

Financial statements from the tax year, including balance sheet and income statement.

02

Records of all distributions made during the year.

03

Comprehensive detail on all income sources, including dividends, interest, and capital gains.

Additional Forms Accompanying IRS Form 1120-RIC

Depending on specific circumstances, RICs may also be required to submit other forms, such as:

01

Schedule A for detailing capital gains and losses.

02

Form 8831 for certain elections related to tax credits.

By understanding IRS Form 1120-RIC, its purpose, and the intricacies involved in filling it out, RICs can navigate the complexities of tax compliance effectively. For those preparing to file, consider reaching out to a tax professional or utilizing resources like pdfFiller to facilitate the filing process. Taking proactive steps now can ensure your organization meets regulatory requirements and capitalizes on applicable tax benefits.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.